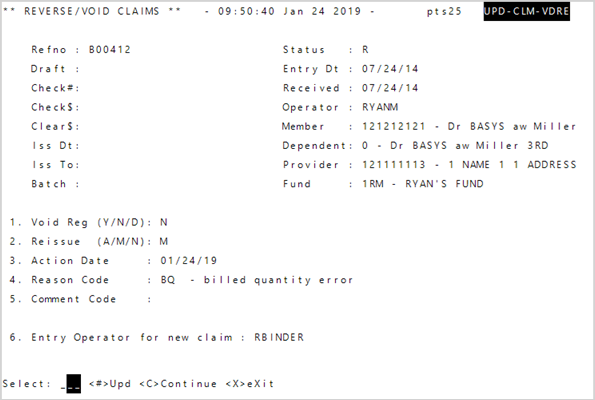

Reverse a claim with a cashed check

Go to: Home > Administration Processes> Claims Adjustments > Claim Reversal/Void

- Enter the claim

Refno. Since the check was cashed and you're reversing the specific claim, use the refno even if it was part of a check with multiple claim payments. - Enter

NinVoid Reg(Void Register) since you don't have the check. - Enter

NinReissuebecause the claim never should have been entered. -

Enter an adjustment

Reason Code

Reason Code -

Enter

Cto continue. The original claim refno displays at the bottom of the screen.Hint: Take note of the refnos that display for any necessary additional processing. - Press

Enter. The claim reverses and the reversed claim refno shows at the bottom of the screen.- Any informational or error messages display.

- Since the Reissue is

N, no claims are reissued and a claim entry session doesn’t display. - Any automatically adjusted and calculated.

- Based on your system settings, an overpayment entry is created for the payee and remains until the money is recovered via a check or a prior payment adjustment.

-

Press

Enteragain to close the screen.Important! If you accidentally void the claim, void it again or reverse it. Enter the adjusted reference # (ex. A00029 in the example below) in Reverse/Void. Void the reversed claim if you're in the same accounting month to return the original claim to its original status or void again if you're in a new accounting month.

Examples are given for illustration. Other errors can generate the same adjustments.

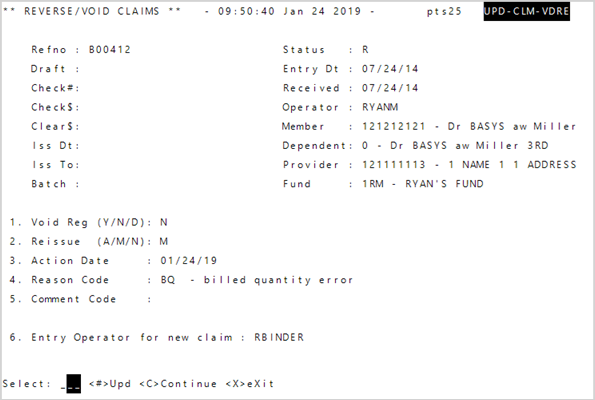

Recover a claim payment adjustment

Go to: Home > Administration Processes> Claims Adjustments > Claim Reversal/Void

- Enter the claim

Refno. Since the check has been cashed and you're reversing the claim, use the Refno even if it was part of a check that includes multiple claims payments. - Enter

NinVoid Reg—Void Register since you don't have the check. - Enter

M—Manual inReissueto re-enter the claim correctly. - Enter an adjustment

Reason Code. The reason code will show in the Adjustment viewport (see Adjustments viewport field descriptions). -

Enter

Cto continue. The original claim refno displays at the bottom of the screen.Hint: Take note of the refnos that display for any necessary additional processing. -

Press

Enter. The reversed refno displays. The claim reverses and any informational or error messages display.Important! If you reverse and reissue the claim in error, you will need to reverse the reissued claim and manually reissue another claim. Don’t void or reverse the original reversal (e.g. A00029 in the example below), this will cause a duplicate payment. - Press

Enteragain and the new claim refno displays at the bottom of the screen.